Your Invoices are critical in the clearing process and adhering to CUSTOMS rules, failure to provide these before arrival slows down the clearing process:

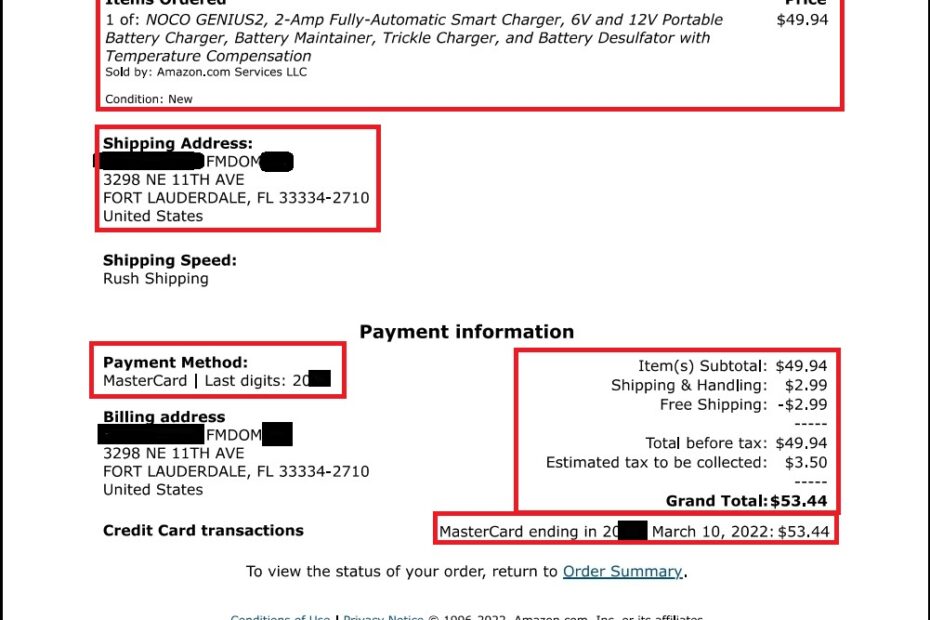

- date of purchase

- name of supplier

- invoice number

- details of items ordered

- cost of items ordered

- total of items ordered

- tax applied

- grand total

- *payment method

Pre Alerting

All consignments must be pre-alerted, and supplier’s invoices sent to Courier Agents/ Small Package Consolidators.

- Any consignment without supplier’s invoices will not be processed (at the time of sorting), by Customs.

- These consignments will be secured at the courier facilities.

- These consignments will be subsequently dealt with by customs on the submission of relevant shipping documents. [not pre alerting slows down the clearing process]

- Courier Agents/Small Package Consolidators MUST indicate on the Bill of Lading/Airway Bill (BL, AWB), the exporter’s name and address. NOTE: Exporter/Shipper field must contain the actual name of the Exporter/Supplier and not the name of the shipping agent or shipping line. This requirement is mandatory, and failure to adhere to this requirement may result in delays in sorting/ processing consignments. [not pre alerting prevents us from having the required information for Customs, which slows down the clearing process]

- Courier Agents/Small Package Consolidators, and Customs to sort shipments to identify and release the packages which qualify under the De Minimis System. [your invoice is required]

- Courier Agents/Small Package Consolidators are required to provide the importer with a receipt (Sec 263 of the Customs Act) containing the classification of the goods, the transaction number, and a breakdown of the duties and taxes paid.

- Duty is payable on all items in a consignment if the consignment does not qualify for De minimis treatment, i.e. if the Cost, Insurance, and Freight (CIF) total is over $150.00 XCD. The applicable duty will be charged on items on importation.

The Customs Act # 20 of 2010, provides for severe penalties for offenses of:

- Improper Importation of Goods (section 45),

- Submitting False Declarations (Section186),

- Counterfeiting Documents (section 187)

- Fraudulent Evasion of Duty (section 189).

Where such violations are detected, offenders are liable to be prosecuted or fined and the goods are liable to forfeiture.